AI Teller for Banking / AI Credit Underwriter

Products & Services

Information

An intelligent banking service assistant powered by Generative AI (GenAI) and Natural Language Processing technologies, integrated across multiple channels including mobile banking apps, online banking platforms. Through conversational AI technology, it provides 24/7 personalized banking services, including account inquiries, money transfers, investment advisory, loan applications, risk assessments, and comprehensive financial services. Customers can interact with the system using natural language, receiving a service experience comparable to conversing with a professional human bank teller.

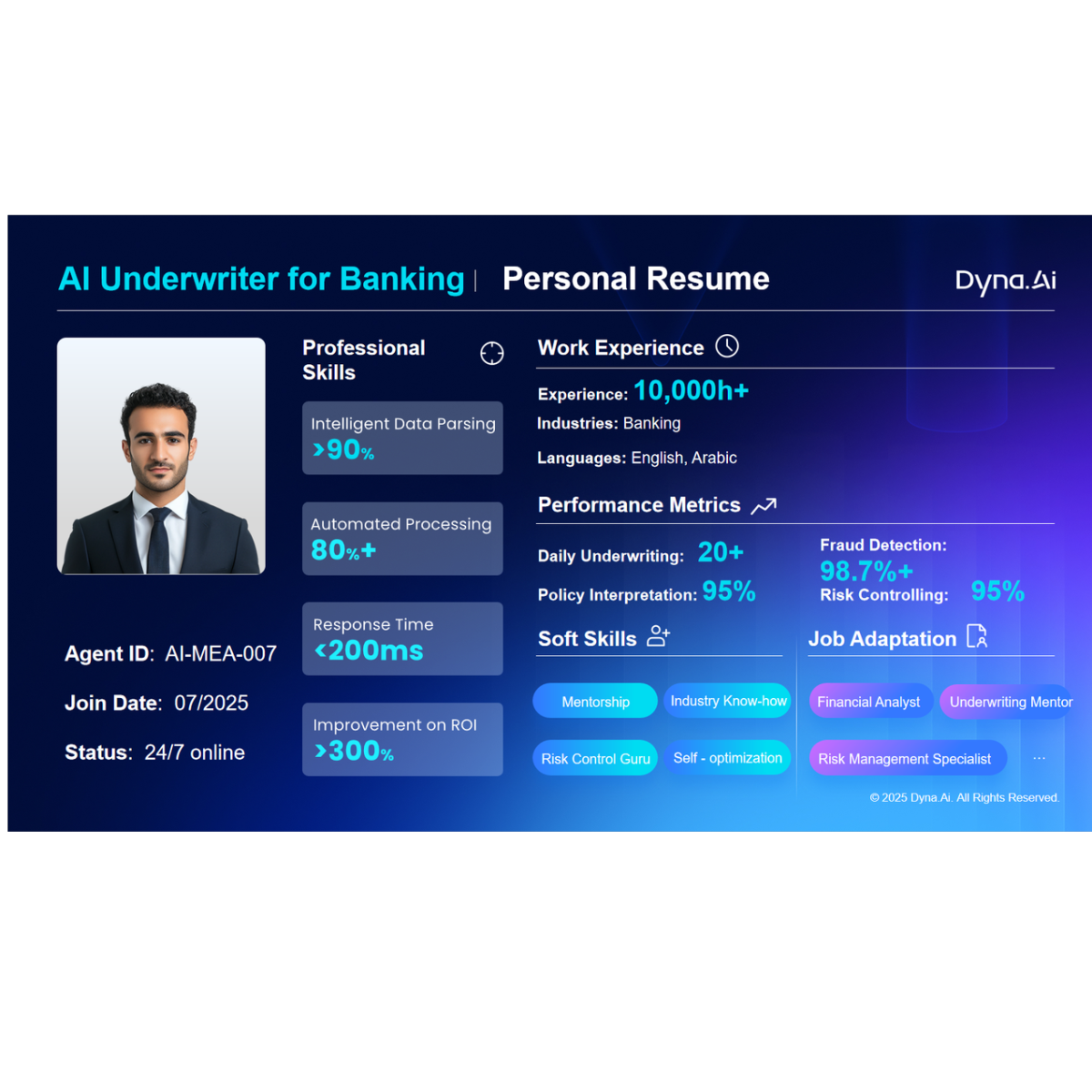

AI Credit Underwriter

We believe the future of banking is not just digital—it’s intelligent. Our AI Banking Suite features AI Credit Underwriter, an enterprise-grade GenAI solution transforming how banks assess credit. Purpose-built for financial institutions, it delivers fast, explainable, and compliant credit insights on demand. Trained on deep banking knowledge, the AI Underwriter analyzes vast data--from financial statements and corporate documents to bureau reports and market signals--turning complex inputs into actionable intelligence. It helps credit underwriters assess risk, detect fraud, and generate credit memos aligned with credit policies and regulatory standards.

Dyna supports end-to-end credit lifecycle management through automated decisioning for retail credit. Leveraging advanced machine learning algorithms, Dyna has developed credit scorecard models that span the entire credit lifecycle, from loan origination and account management to collections. Our EKYC solution is an AI-powered identity verification tool designed to streamline and secure the customer onboarding process.