Comfi

Startups & Scaleups

Information

Comfi is a fintech startup born in Dubai, built to solve one of the most pressing challenges facing SMEs across the MENA region: cash flow delays. In a region where payment terms often stretch to 60–90 days, many small and medium-sized businesses struggle to grow or even survive while waiting to get paid. That’s where we come in.

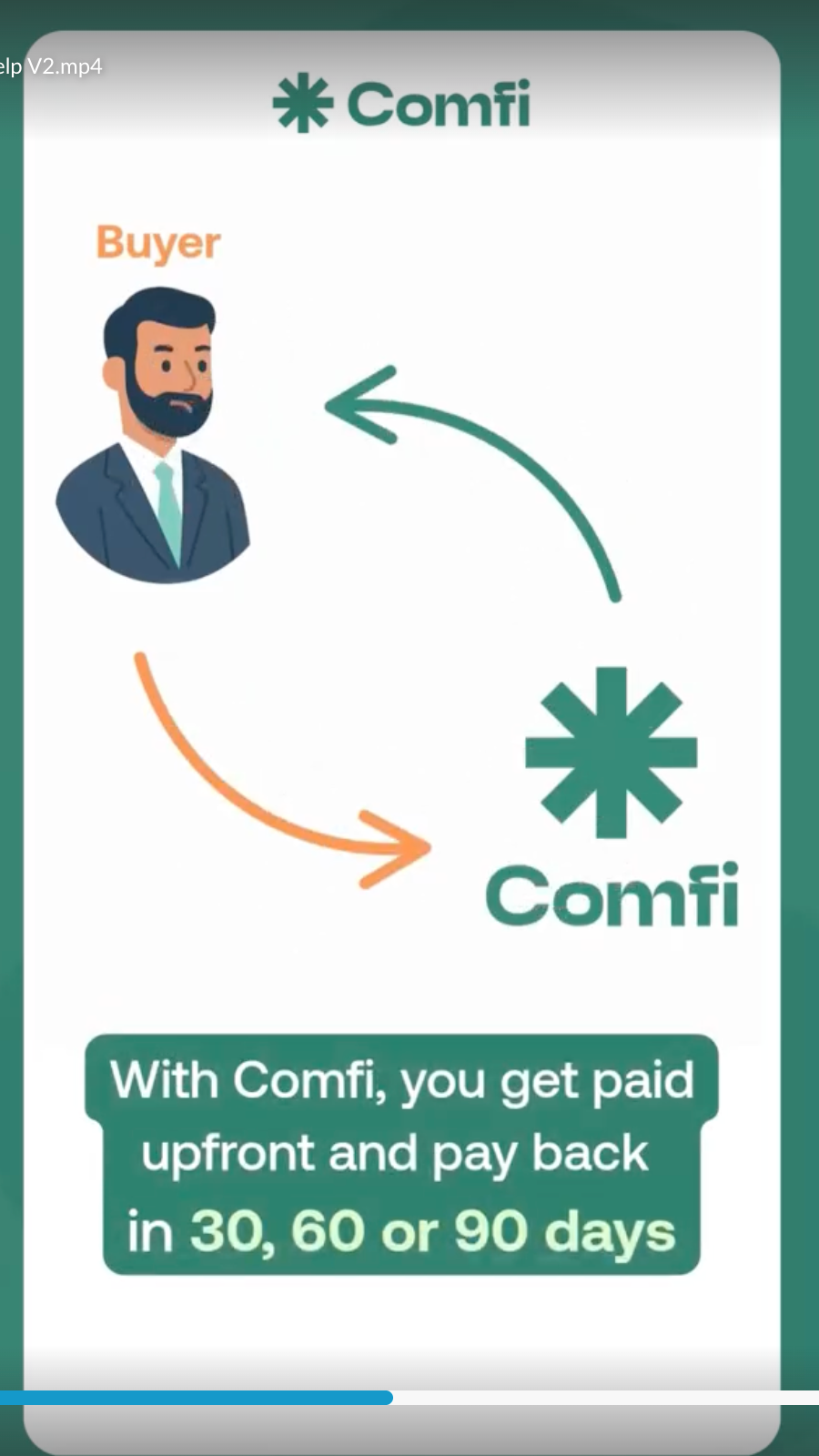

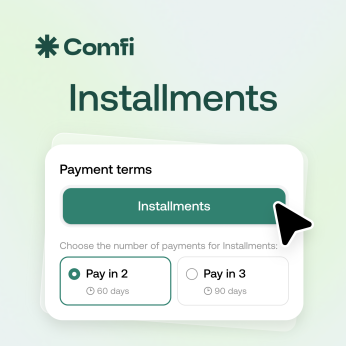

Comfi empowers SMEs with instant access to working capital through two core products: Buy Now, Pay Later (BNPL) for B2B and Invoice Discounting. We pay suppliers and service providers upfront, and their buyers or debtors pay us back later - in 30, 60, or 90 days. This means SMEs get paid immediately, avoid cash flow gaps, and can reinvest in growth without waiting months for receivables.

Unlike traditional banks, Comfi moves fast; approvals within hours, minimal paperwork, and no collateral required. We’re more flexible, more accessible, and designed with SMEs in mind.

Today, Comfi is a team of 40 people across the globe, serving the MENA region’s SME backbone. Whether it’s unlocking delayed receivables or enabling growth through flexible payment terms, we’re on a mission to help businesses grow faster and smarter.